The Borang E must be submitted by the 31st of march of every year. Walau bagaimanapun majikan dikehendaki menggunakan versi Bahasa Malaysia Borang E CP8-Pin.

Panduan Mengisi Borang Keberhasilan Pbppp 2016 Pengetua Guru Besar Guru

Borang E is an Employers annual Return of Remuneration for every calendar year and due for submission by 31st March of the following calendar year.

. According to the Income Tax Act 1967 Akta 53. ZB Ke Luar Negara Borang ZB No. 31 Mac 2018 a Kegagalan mengemukakan Borang E pada atau sebelum 31 Mac 2018 adalah menjadi satu kesalahan di.

1 Tarikh akhir pengemukaan borang. The deadline for filing tax returns in Malaysia has always been. May 15 for electronic filing ie.

B Kegagalan mengemukakan Borang E pada atau sebelum 31 Mac 2020 adalah menjadi satu kesalahan di bawah. A Kegagalan mengemukakan Borang E pada atau sebelum 31 Mac 2018 adalah menjadi satu kesalahan di bawah perenggan 1201b Akta Cukai Pendapatan 1967 ACP 1967. 2 In the Payroll module head into Payroll settings Form E.

Atau b Luar Malaysia tidak melebihi sekali dalam satu tahun kalendar terhad kepada RM3000. Borang E kertas jika dikemukakan oleh Syarikat adalah DIANGGAP TIDAK DITERIMA bagi maksud di bawah subseksyen 831B ACP 1967. Any dormant or non-performing company must also file LHDN E-Filing.

Siri Majikan E Penyata Gaji Pekerja AGENSI KERAJAAN EC. Majikan yang aklumat melalui e-Data Praisi tidak perlu mengemukakan Borang CP8D. Offered in limited slots first-come-first-served basis.

Untuk makluman majikan dikehendaki. April 30 for electronic filing ie. All partnerships and sole proprietorships must now file.

All companies must file Borang E regardless of whether they have employees or not. NOTA IRINGAN BORANG E BAGI TAHUN 2016 1. Borang Btgs By User Pdf Archive.

Dalam Malaysia termasuk perbelanjaan penginapan dan makanan tidak melebihi 3 kali dalam satu tahun kalendar. Borang E hanya akan dianggap pada atau sebelum 31 Mac 2018. WP0218 BORANG E 2017 PERINGATAN PENTING 1 Tarikh akhir pengemukaan borang.

Majikan yang telah menghantar maklumat melalui e-Data Praisi tidak perlu mengemukakan Borang CP8D. URUSAN SERI PADUKA BAGINDA BAYARAN POS JELAS POSTAGE PAID PUSAT MEL NASIONAL SHAH ALAM MALAYSIA NO. Click Generate Form E for 2022 to generate Form E for the specific YA indicated.

Lembaga Hasil Dalam Negeri Malaysia LHDNM ingin memaklumkan bahawa pengemukaan Borang Nyata Cukai Pendapatan BNCP Tahun Taksiran 2016 melalui e-Filing bagi Borang E BE B BT P M MT dan TF boleh dilakukan mulai 1 Mac 2017. As an employer this will be your responsibility to ensure that the rest of your employees get their forms by the month of February every year. Kegagalan mengemukakan Borang E.

Any dormant or non-performing company must also file LHDN E-Filing. 31 Mac 2020 a Borang E hanya akan dianggap lengkap jika CP8D dikemukakan pada atau sebelum 31 Mac 2020. With Malaysia Government Subsidy you can have a certified highly accurate and trustworthy SQL Payroll Software at 50 of the original price now.

All companies must file Borang E regardless of whether they have employees or not. 1 Click on Payroll module to access the Form E section in Talenox. Borang E bagi Tahun Saraan 2016 adalah 31 Mac 2017.

April 30 for manual submission. 3 In the Form E generation page choose the Form E YA Year of Assessment at the top which by default is usually the latest YA. As of 2022 the deadline for filing Borang E in Malaysia is.

March 31 for manual submission. Borang e 2017_1 1. EA Form in Excel Download.

EA Form in PDF Download. All partnerships and sole proprietorships must now. Section 83 1A Income Tax Act 1967.

2016 bagi tujuan pengemukaan kepada LHDNM untuk Tahun Saraan 2016. A melengkapkan dan mengemukakan satu penyata yang dilampirkan mengikut peruntukan subseksyen 831 Akta Cukai Pendapatan 1967 ACP 1967. Every employer shall for each year furnish to the Director General a return in the prescribed form.

According to the Inland Revenue Board of Malaysia an EA form Malaysia also refer to Borang EA EA Statement EA Employee is an Annual Remuneration Statement that every employer shall prepare and render to his employee statement of remuneration of that employee before 1st March in the year immediately following the first mentioned year.

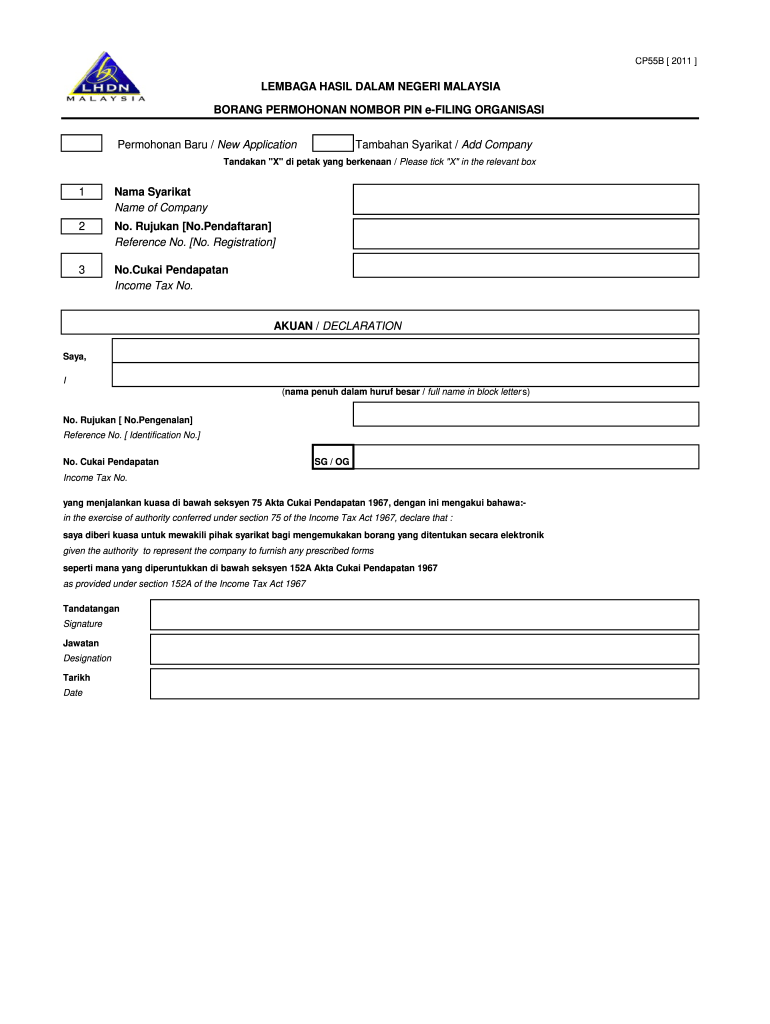

Borang Cp55d Fill Online Printable Fillable Blank Pdffiller

How To Step By Step Income Tax E Filing Guide Imoney

Borang Tp3 2015 English Version Pdf Employee Benefits Government Finances

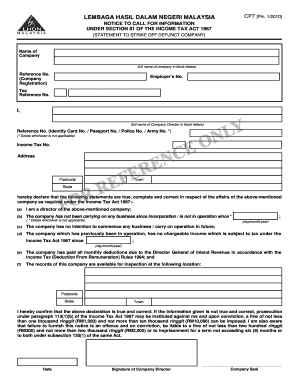

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Kc Tax Services This Is Letter Cp356 From Irb Regarding E Data Praisi System Application For Prefill Of Salary Information For Ya 2016 Onwards Facebook

Jawatan Kosong Spa September 2016 Pegawai Tadbir Dan Diplomatik Gred M41 Penolong Jurutera Gred Ja29 302 Kekosongan

Balik Kampung Dengan Bas 707 Inc Express Bus

3 Types Of Homeownership Costs In Malaysia Quit Rent Parcel Rent And Assessment Rates

How To Step By Step Income Tax E Filing Guide Imoney

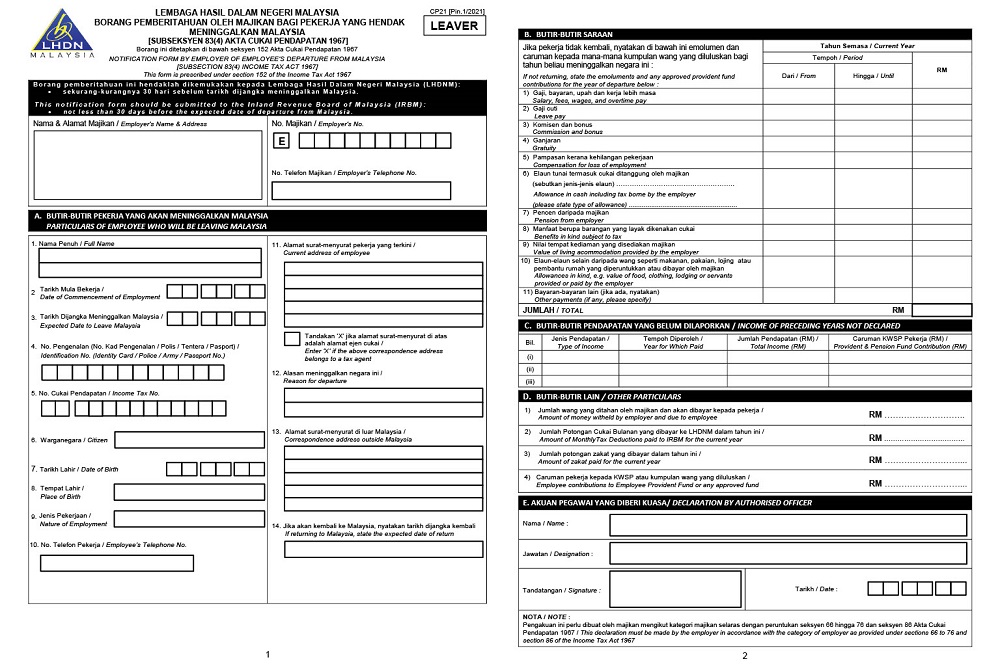

Permohonan Ke Luar Negara Online Kpm Fill Online Printable Fillable Blank Pdffiller

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Borang Keahlian Persatuan Pengamal Utama Perubatan Naturopathy Malaysia M A N I S

Hr Guide Tax Clearance Letter Form Cp22 And Form Cp22a

Borang Be 2021 Pdf Fill Online Printable Fillable Blank Pdffiller

Form Cp55d Attached As Per Calcol Management Services Facebook

Malaysia Tax Clearance Documents Denric Denise

Confluence Mobile Support Wiki

Borang Tp1 The Lesser Known Tax Relief Form Your Employer Did Not Tell You About